- This topic has 0 replies, 1 voice, and was last updated 9 months, 2 weeks ago by .

-

Topic

-

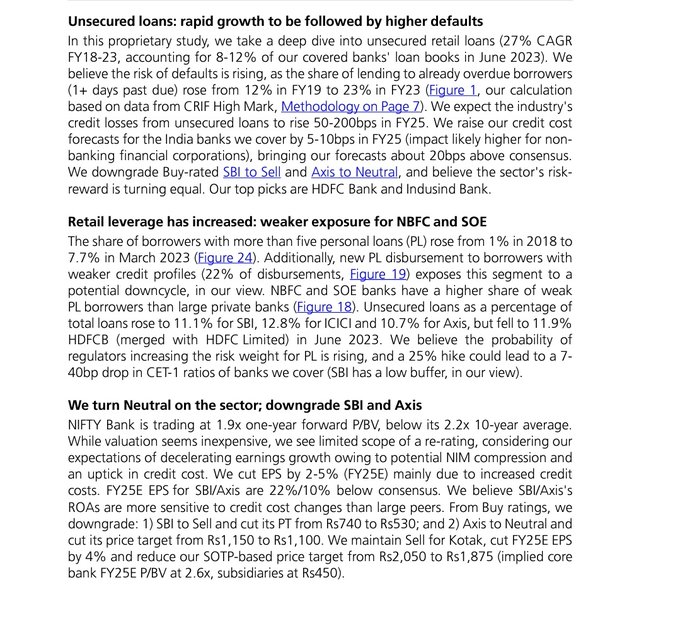

Nifty Bank is trading at 1.9x 1-year fwd P/BV with limited upside. Risk-reward neutral. Rapid growth in Unsecured retail loans will be followed by higher defaults. RBI could increase risk weight for personal loans which will increase credit cost & compress NIMs. Sell SBI, Kotak

UBS Downgrades Indian Banks

Downgrades:

1) SBI to Sell, cut its PT from Rs740 to Rs530

2) Axis to Neutral and cut its price target from Rs1,150 to Rs1,100.

3) Maintain Sell for Kotak, cut FY25E EPS by 4%, reduce SOTP-based price target from Rs2,050 to Rs1,875

- You must be logged in to reply to this topic.